Wolf Crypto ICO Review: Lition

Website: https://www.lition.io

Telegram: https://t.me/LitionEnergy

Whitepaper: https://www.lition.io/docs/Lition_Whitepaper.pdf

Medium: https://medium.com/lition-blog

Github: https://github.com/lition-blockchain

Telegram: https://t.me/LitionEnergy

Whitepaper: https://www.lition.io/docs/Lition_Whitepaper.pdf

Medium: https://medium.com/lition-blog

Github: https://github.com/lition-blockchain

Update: Lition have released details of their banking partnership. The partnership is with “ two cooperatives of the German VR Bank” who is a “ is a German co-operative banking group that together has 11.000 branches, 915 cooperatives, assets of € 891 billion and 18.5 million customers as of 2017”.

More details can be found in the article below.

As blockchain technology has developed and matured over the past few years, there has been a dynamic shift in the thinking and adoption of current public based blockchain infrastructure and how such infrastructure meets the needs of enterprise, rather than that of the general public. While permissionless public blockchains have led the awareness and adoption campaign for the general user, it is fair to say permissionless public chains have come up short regarding the needs of enterprise and the level of control such enterprises require over the underlying blockchain and the data contained within.

With recently regulatory changes in Europe leading to the establishment of General Data Protection Regulation (GDPR), this has resulted in even more emphasis on the development of blockchains that support private blockchain models, especially ones that allow for the deletion of user data, something that businesses building on the blockchain will need to remain compliant with if they are to deal with any European user base.

Lition: The Blockchain Standard Infrastructure for Business

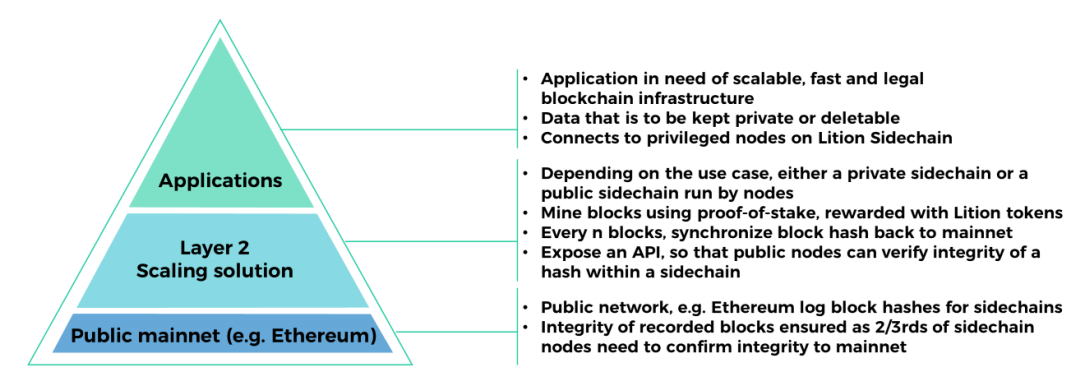

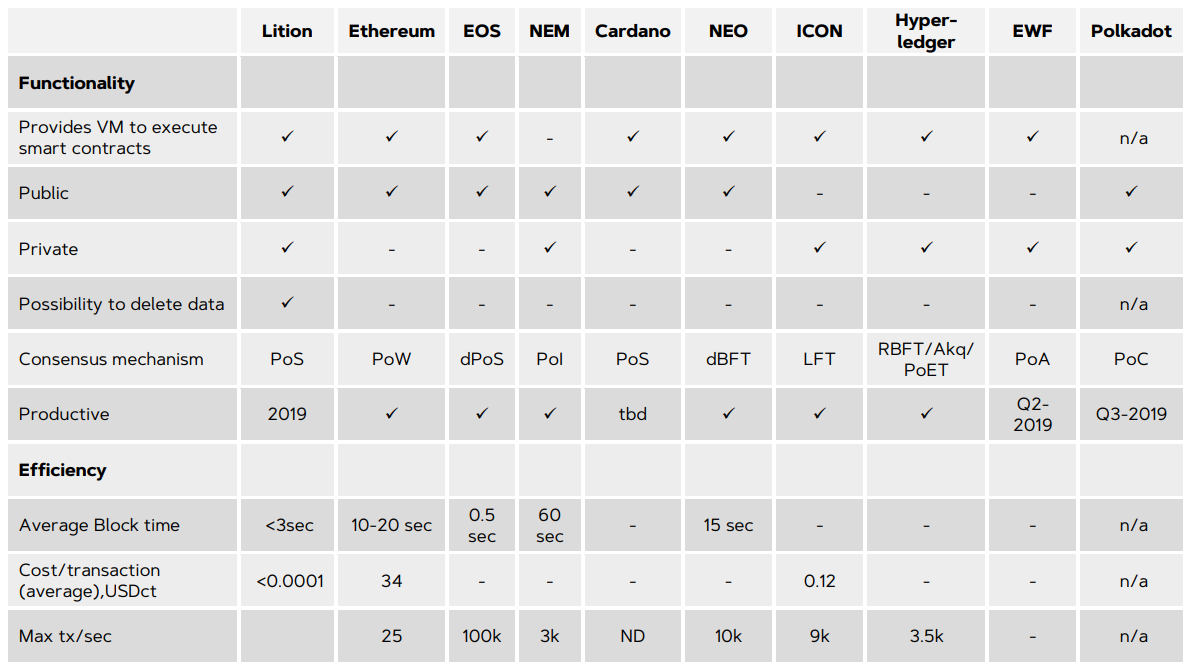

Lition, in its entirety, is a fully fledged blockchain and dApp ecosystem, built as a layer 2 scaling solution on top of Ethereum. Lition includes a bespoke data separation & deletion structure that allows for the use of public/private sidechains that are compliant with GDPR regulations and powered by nodes and staking mechanisms, while also allowing for optimised transaction costs and block confirmation times.

1 — The Lition Blockchain

Lition lists the following points as their main selling points/points of difference to other blockchain projects —

- Private Sidechains

Past enabling improvements to current blockchain bottlenecks, such as transaction cost and block confirmation times, this is critical point of difference of the Lition chain as compared to other offerings. By having private sidechains (which can also be public if necessary based off the demands of the client) Lition is not only able to implement these performance improvements, but also to facilitate the separation and deletion of data.

- Light Client

As a layer 2 solution, Lition clients only need to connect to the relevant sidechain to interact with the network. This reduces overhead as clients can sync the much smaller (approx 40mb) sidechain instead of the full mainchain (ETH is between 40GB — 300GB, depending on the client used). This allows for easy deployment of thin clients (such as IoT devices) on the Lition network.

- Low Transaction Costs

Lition have moved Gas transactions onto their sidechains and as such have been able to cap transaction costs on the network to a maximum of 0.01c USD. This is appealing to enterprise clients, as they are able to budget fixed transactionary costs on their networks.

- Fast Block Confirmations

By moving the bulk of transactions (baring mainnet sync which happens in the background) to sidechains and with these sidechains being serviced by designated node infrastructure, Lition is able to reduce block confirmation time to under 3 seconds. This is obviously appealing to those looking to build dApps on top of a blockchain solution in which fast block confirmation times are a requirement (for example a payment application…it’s unrealistic for a customer at a store to wait 10-20 seconds + for a transaction to confirm).

- API Access

Lition is developing an SDK that allows for easier integration of Lition’s blockchain into enterprise applications, looking to move to a blockchain based solution. This obviously adds to the usability and adoption claims of the project as easier integration = more adoption.

Due to being built on top of Ethereum, Lition requires a periodic sync to the main chain. Synchronisation can be set by the sidechain owner either by the number of transactions that have to occur before the synchronisation happens or the time interval between synchronizations…or both. Lition have provided an economic modelling example of these sync costs in their whitepaper.

2 — Lition dApps

- First Lition Use Case — P2P Energy Exchange

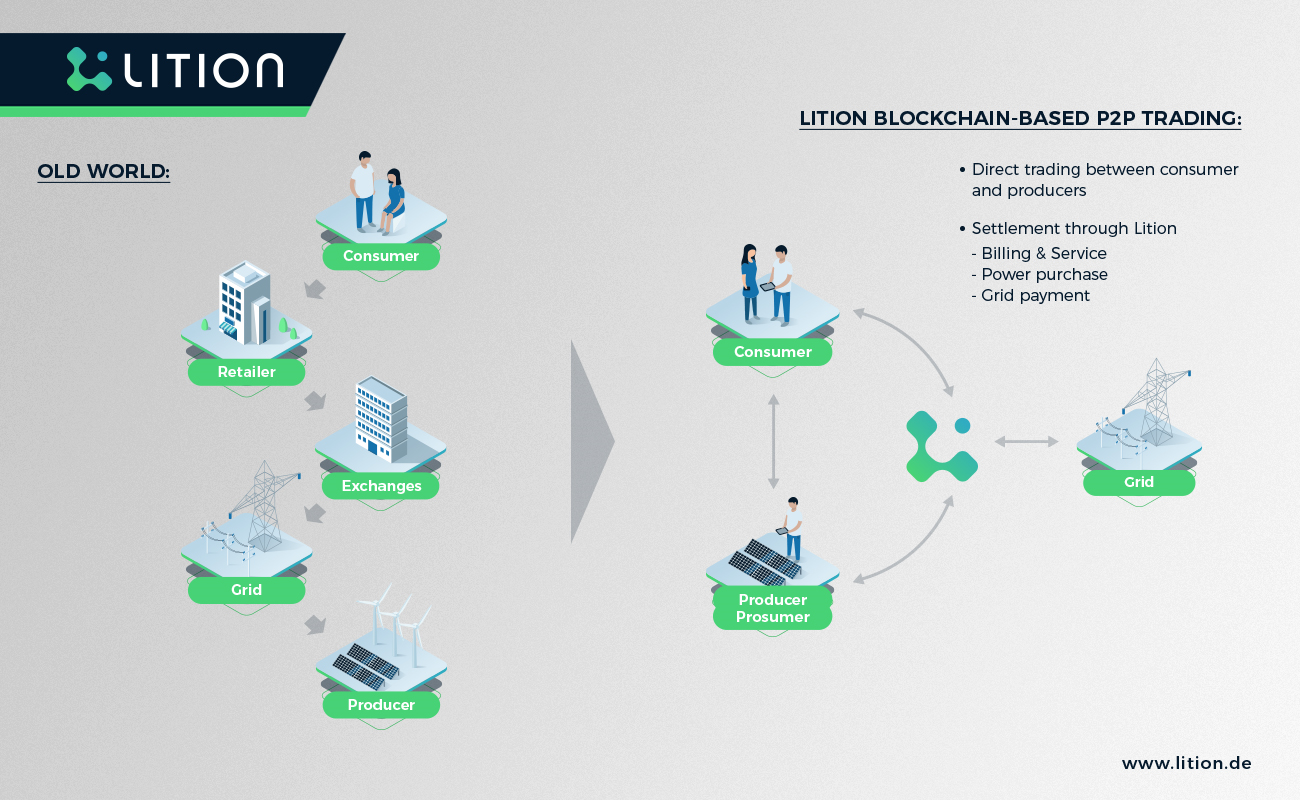

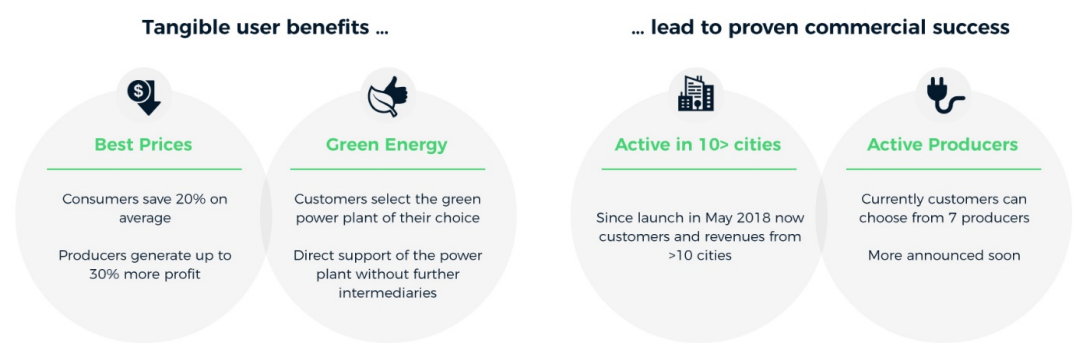

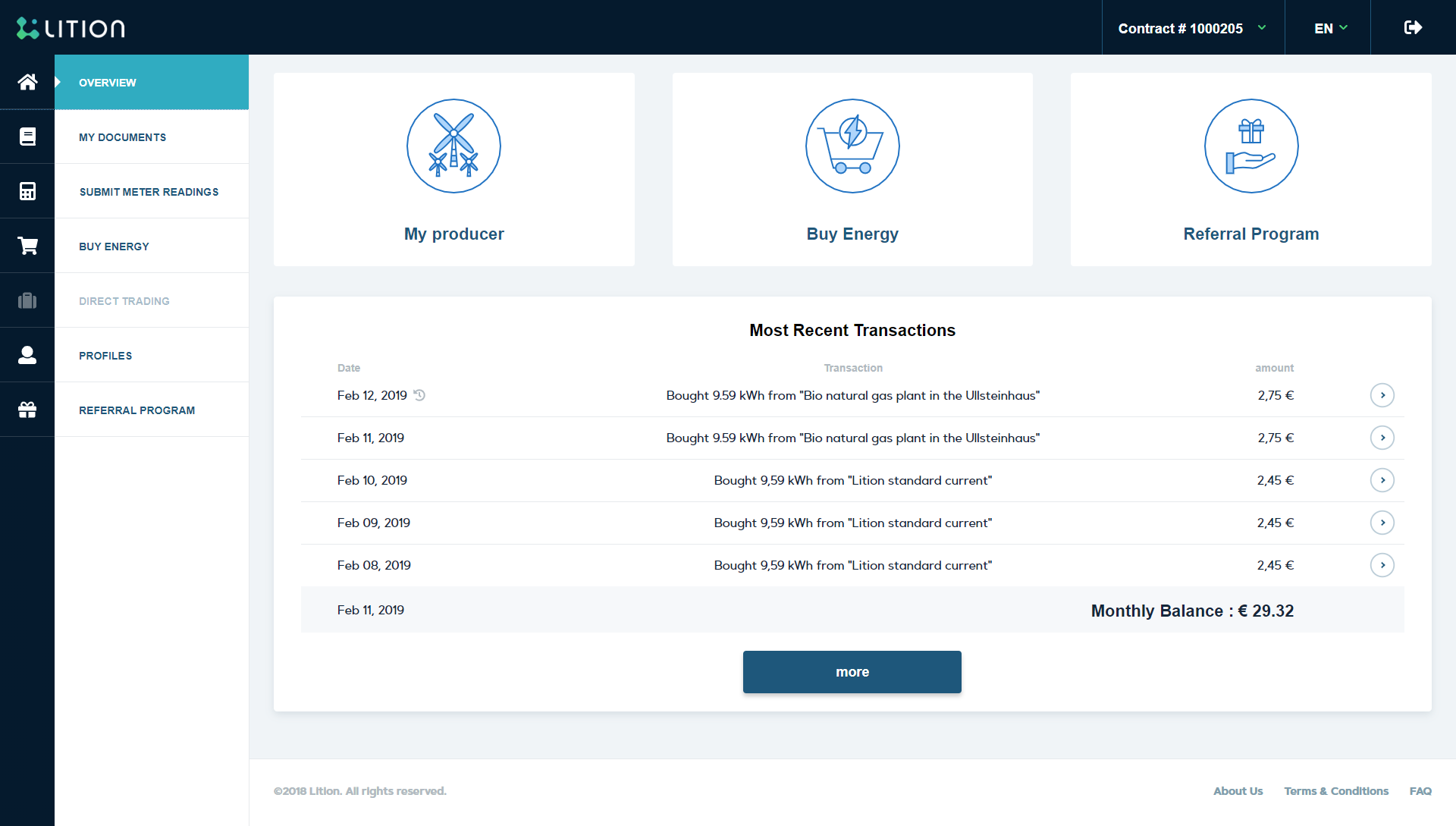

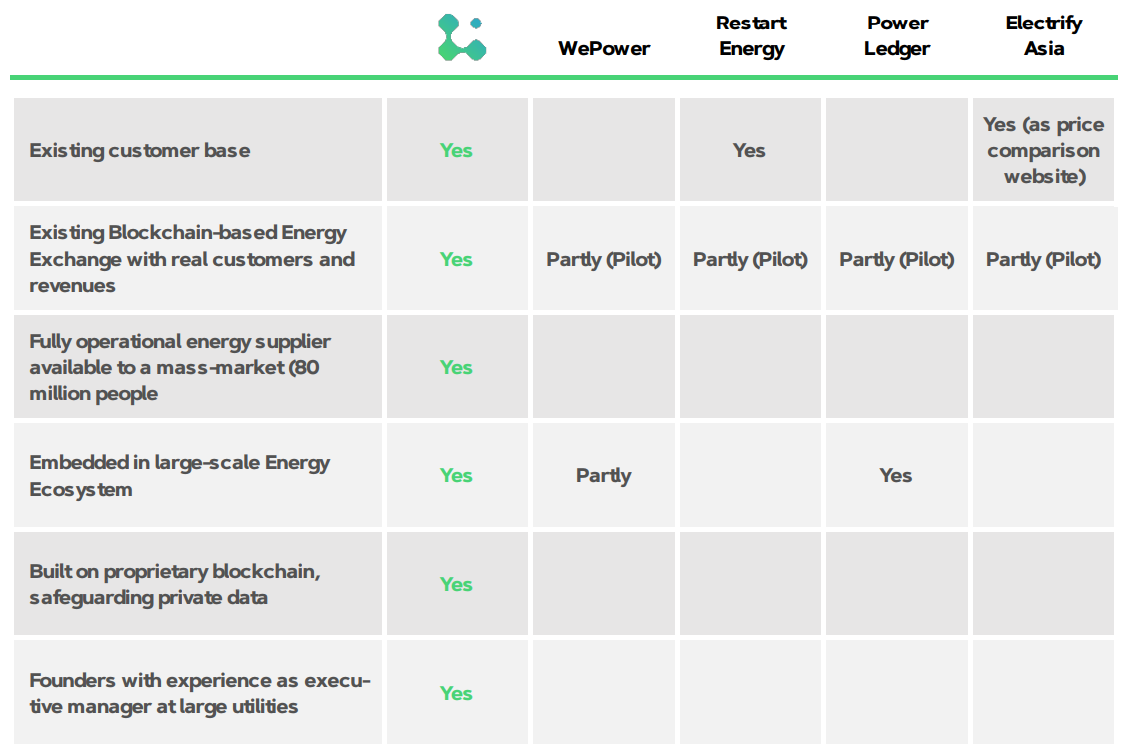

Lition’s main use case at this point in time is their P2P Energy Exchange application. In a similar vein to WePower, Restart Energy, Power Ledger, Electrify Asia and Enosi, Lition are tapping into the renewable energy sector and allowing for direct trade of energy between energy producers and consumers. This essentially allows for reduced energy costs (average of 20% reduction) to the consumer, as they are able to cut out the middleman, the energy retailers, and deal directly with the energy producers themselves. This works both ways, as energy producers are also able generate up to 30% more profit by dealing directly with the consumer. This green energy approach is particularly interesting moving forward in Litions target market with Germany recently committing to phase out all phase out coal-fired power stations by 2038.

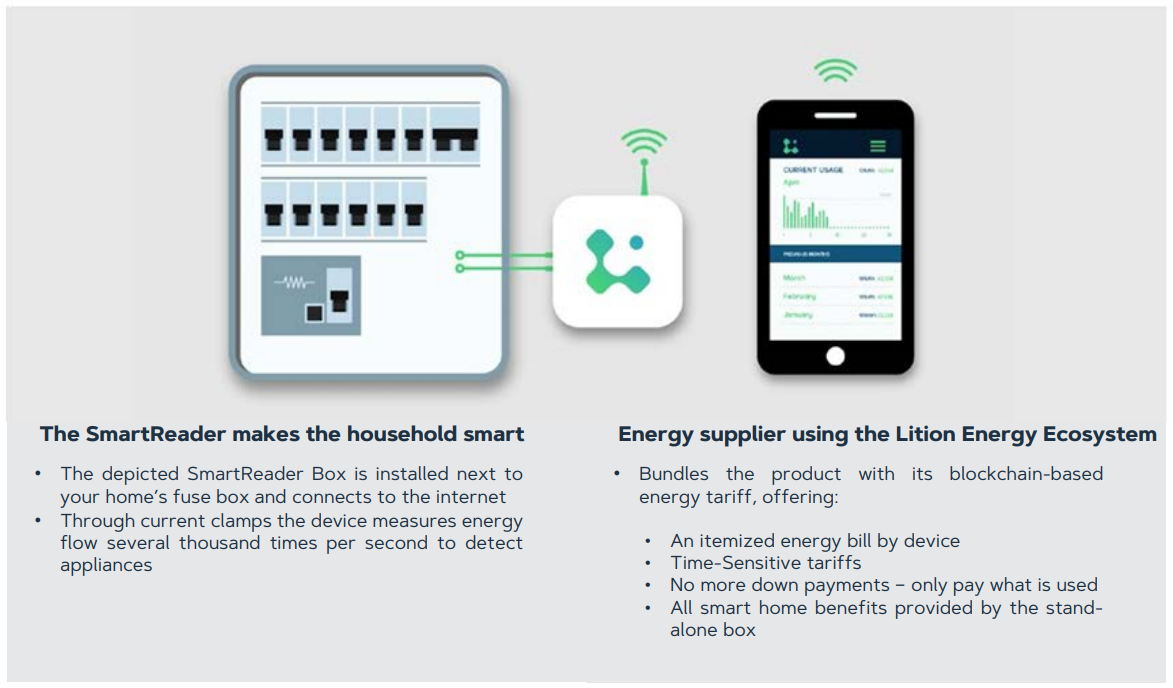

The use of blockchain in this scenario is twofold, firstly by using blockchain/tokens this allows for the direct trading and tracking of energy between energy producers and consumers (energy tracking works via the use of smart readers integrated at the consumers end).

Secondly this acts as “proof of provenance”, i.e proof that energy purchased from a prouder did indeed come from said producer and at the applicable charged rate. This is particularly relevant in comparison to the traditional energy market, in which energy retailers sell green power solutions at a higher per k/w to consumers, with consumers having to blindly trust the energy retailer did indeed supply the more expensive green power and not marked up cheaper, dirtier coal power.

Lition have an up and running MVP of their energy exchange, currently connected to seven energy producers. The MVP is publicly available using the link below. Login details for the MVP are —

Username: demo

Password: demo1234

Password: demo1234

Lition have already published the source code for their Energy use case MVP front end and Smart Contracts on their Github for peer review. More details can be found in the article below.

- Second Lition Use Case — Banking/Syndicated Loans

Lition’s second use case is being developed in partnerships with VR Bank and a “real estate development company (>100 million USD)”. Essentially this is a syndicated loan functionality that leverages a real estate development as the backing asset. Lition have stated more details on the real estate partnership will be available in early March, prior to the TGE.

- Additional Lition Use Cases

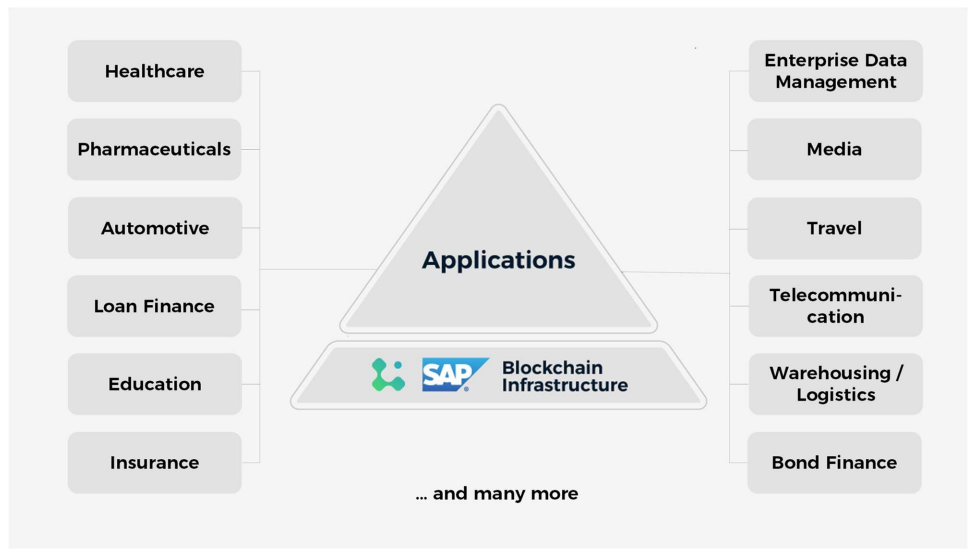

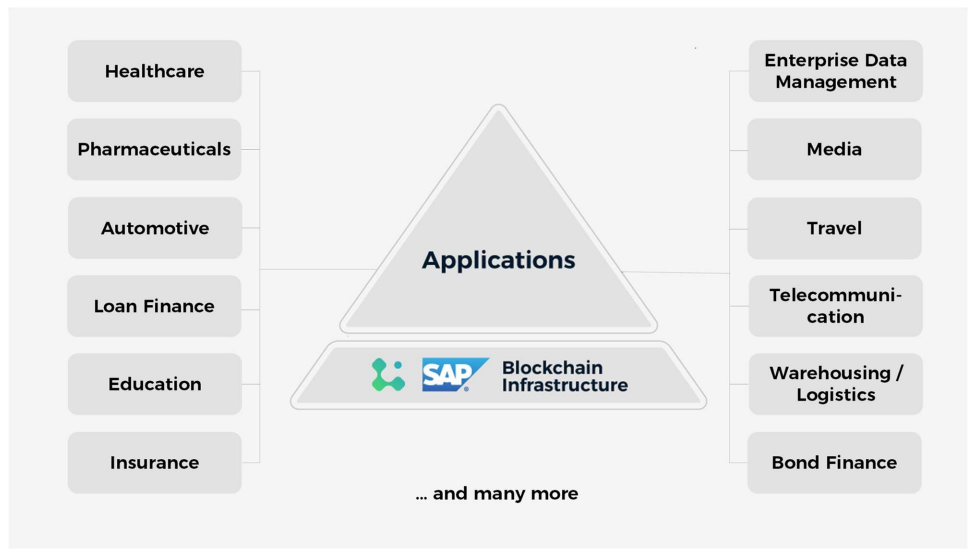

Lition’s additional uses cases at this point in time rest on the ability to leverage their chain in partnership with SAP as an offering to other industries and customers requiring a GDPR compliant blockchain solution. This is discussed in more detail in the Competitor and Partnership sections below.

Token Utility

There are three main utility functions for the LITION token within the Lition ecosystem.

- Payment for Transactions

Much like Ethereum, Lition sidechains require Gas to transmit transactions to the network, however unlike Ethereum, in which Gas costs fluctuate (and at times quite severely) based off the volume of transactions on the network, Lition has set Gas to a maximum cost of 0.01c USD per transaction. This allows wider enterprise appeal as enterprises/dApp authors are able to set a fixed budget for transactionary costs on the network.

- Staking and Miner Nodes

To stake on the Lition network the minimum amount of tokens required is equivalent to $100 USD. At ICO price, this amounts to 1000 LITION tokens however this will fluctuate based off token price once the token hits the open market. Staking on Lition is done on a per sidechain basis, meaning token holders will “subscribe” to a particular sidechain, and their rewards will be based off the transactionary volume of that particular chain and the amount of staked tokens held by the user.

To run a miner node the required stake is $2000 USD, or at ICO price, 20 000 LITION tokens. Again, in time this will fluctuate based off the open market token price with the peg being set in USD value rather than in tokens. As per the “How are tokens staked” image, miner nodes process blocks on specified sidechains and miners are rewarded every time the sidechain syncs with the Ethereum blockchain. In this structure minder nodes hold a historical sidechain data and also act as validators in regards to verifying and ensuring correct network behaviour by network participants.

During the Genesis phase of the Lition chain, set to run for a maximum of two years, Lition will provide additional rewards to stakers regardless of the volume of transactions on the Lition chain. This has been put in place to incentivise staking nodes to join the network in the initial stages in which transactionary volume is low, resulting in a negative cost proposition for node owners to run a node without additional incentivisation.

As is the case with any PoS network, staking and locking tokens to nodes has the obvious benefit of restricting tokens from the overall circulating supply, putting upward pressure on the token price.

- Creation of Private Blockchains (sidechains)

Lition sidechains are used to store public and/or private data and can be deployed at an application level by developers, i.e each application can use it’s own sidechain. While creation of a sidechain is free, the owner of a sidechain will need to pay “rent” in LITION tokens, based off the storage size of the sidechain. There is currently no supplied details in the whitepaper as to modelling on rent required on specific storage sizes.

It is hard to come to any definitive conclusion on this model without any economic modelling as to how many LITION tokens are required based on the amount of storage required. Further details on this point are welcomed from the Lition team.

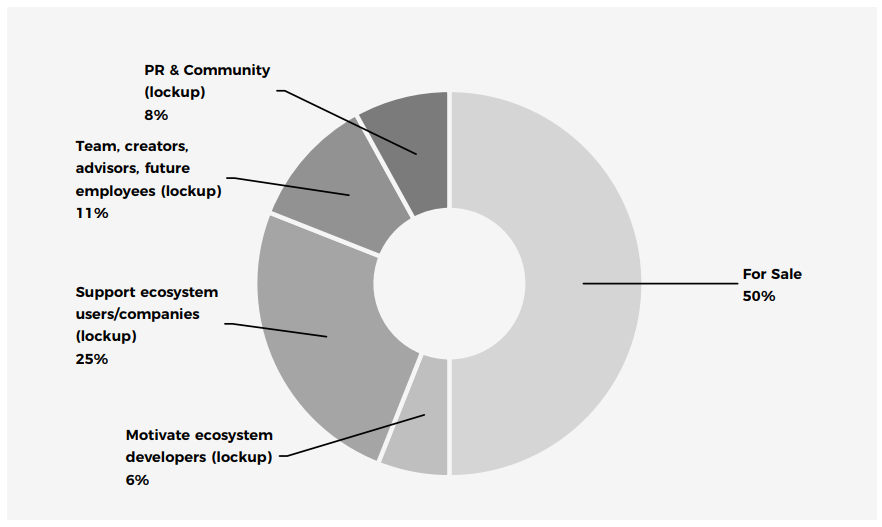

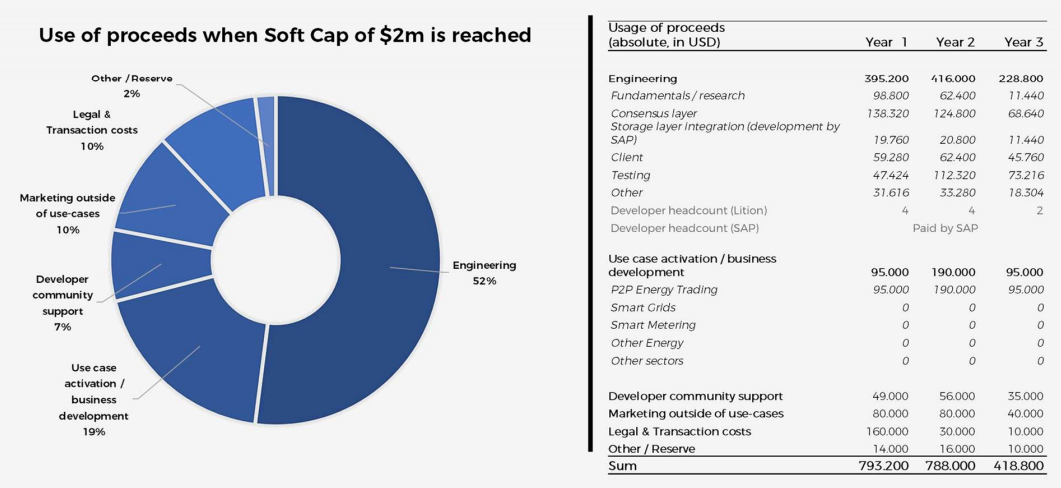

Token Metrics

The Lition project has a hardcap of $8m USD (wisely reduced from $25m over the past few months) with $2m USD already raised during the seed round. A total of 172 million LITION tokens will be minted initially (keeping in mind up to an additional 7 million tokens could be minted as part of the HODL Highway), with 50% of these (88 million) available for sale during the seed, private and public rounds. The LITION token has an ICO price of 0.10c USD and will be issued as an ERC-20 token on Ethereum.

Seed attracted an average bonus of 40% while the private sale has no bonuses and the public sale has a 1–7% bonus. With no bonus and a lock on private sale tokens, there seems to be no incentive for VC funds to invest in the private round, as they could simply purchase tokens from the public sale at a better rate and without the token lock attached to the private sale. As such, the intention of the private sale seems to be to attract potential enterprise users, as instead of offering bonus tokens, private sale contributors instead are given exclusive rights to developer and testnet access (how much of an inventive that is, we’re not sure…).

The public sale for Lition is scheduled for the 18th of March with $2–3m USD cap (exact amount is yet to be confirmed). With $2m USD already raised in seed, this leaves $3m available in the private sale. It is unclear at this time as to how much has been raised in the private sale, with Lition stating results of the private sale will be published in early March, prior to the public sale.

The public sale will be run in two rounds, with the first round capped to $0.5m USD and only available to whitelisted users, with a 7% bonus applicable to the entire round. This round will run for 48 hours from the 18th of March. The second round will have a $1.5–2.5m USD cap, run for 120 hours from the 21st of March, open to all users and will start with a 4% bonus, reducing by 1% each day of the round.

Lition have recently released more detail on their token sale, detailed in the article below.

Past the 50% of tokens available for sale, 39% of the remaining tokens are being used to support the Lition ecosystem, with 25% designated to support companies and users looking to use the Lition ecosystem (essentially a business development fund in which companies will receive token bonuses for bringing services across to Lition), 8% allocated to PR & Community (to be used for further marketing and community campaigns) and the remaining 6% used to incentivise developers looking to build dApps on the Lition platform. The last 11% of tokens are assigned to the team and advisors.

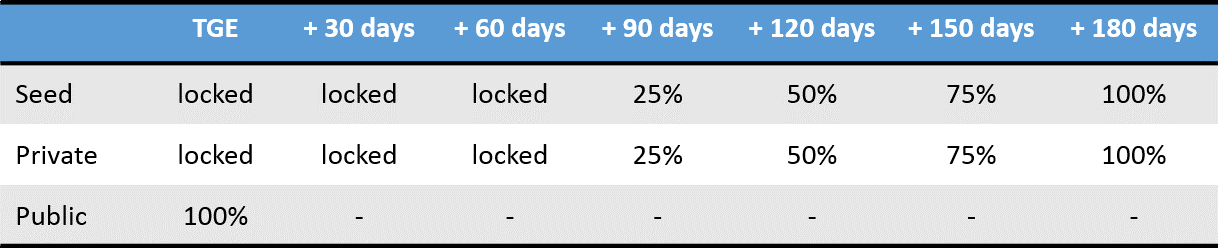

As per the above, seed and private sale tokens are locked for a period of three months, vested over a four month period post the initial lockup. Public sale tokens are fully unlocked once the TGE is completed. Advisor tokens have the same lock as seed and private while team tokens are vested at 25% unlock every six months over a two year period. The PR & Community fund is vested over a year period, unlocking at 25% every three months, the Ecosystem Users/Companies fund has 12.5% tokens unlocked after the TGE with additional 12.5% increments unlocking every three months until the full fund is unlocked. The Ecosystem Developers fund also unlocks at the same structure as the Ecosystem User/Companies fund.

Lition have stated these ecosystem tokens will be used to incentivse users staking and running nodes on mainnet and as such, will not be part of the secondary market circulating supply.

Similar to LTO, Lition have introduced a token protection mechanism for investors, however unlike LTO’s Bridge Troll, Lition’s token protection mechanism is called the HODL Highway and instead of acting as a disincentive as per the Bridge Troll, in which tokens are burnt as they move from mainnet tokens to ERC-20 tradeable tokens, with the percentage of burnt tokens based off the length of time tokens have been held for, the HODL Highway instead acts as an incentive, providing additional bonus tokens to token holders who lock tokens into their contributing wallet address for certain time periods.

Past the obvious difference of distinctive/incentive in the two token protection structures, the main difference of note is that the Bridge Troll method burns tokens and as such has the dual effect of both locking tokens from the overall circulating supply, while reducing the overall circulating supply as tokens are burnt (deflationary), while the HOLD Highway locks tokens from the overall supply and actually adds tokens to the overall circulating supply (inflationary). Lition have stated that up to an additional 7 million tokens will be minted on top of the 172 million tokens supply to facilitate these bonus payments. Of course this will most likely be much lower as this figure is based off all users holding tokens for the full six month period.

More details on the HODL Highway can be found in the article below.

Additional to the HODL Highway is Lition’s “Guaranteed Refund Parachute”. Similar to the HODL Highway, this is an opt in program that enables a TGE contributor to claim back 50% of the initial USD invested amount in the TGE at the six month mark after the date of the TGE. Users will need to chose between the HOLD Highway (up to 30% upside) or the Guaranteed Refund Parachute (50% reduced downside) as only one program is applicable per contributor. Lition will be moving the required funds for the refund program into DAI after the TGE and publishing an Ethererum address and Refund Program smart contract two weeks after the TGE for full transparency, so contributors can be sure these funds will be available at the point of claim.

More details on the Guaranteed Refund Parachute can be found in the article below.

50% of all available tokens is in the range of an ideal token sale offering, however this is tempered by the fact that the general public will only have access to approximately 25% of these 50% of tokens. Based off some “quick mafs” and the current intended structure of the sale/available data, post sale, from a total of 88m tokens, seed will hold approximately 28m tokens, the private sale will hold approximately 30m tokens and the public sale 25m tokens.

What does make this interesting is the locks on seed and private. As both tranches are locked for a minimum of three months, this means the initial circulating supply will be limited to the public sale round plus unlocked tokens from the ecosystem funds (by our calculations approximately 16.2m tokens across both funds). In an ideal world, the team would not be unlocking this percentage of ecosystem tokens directly after the TGE, however Lition have stated these ecosystem tokens will be used to incentivse users staking and running nodes on testnet and as such, will not be part of the secondary market circulating supply.

If that were to be the case, this would put the circulating supply of tokens at ICO price for the first three months at $2.5m (less if the public sale does not sell out, as unsold tokens are burnt). In the short term, with an early listing, this could be of a similar vein to LTO, based off the partnerships in play and low circulating supply.

One other aspect to take into consideration is the unlock of team and advisor tokens. Advisor tokens start to unlock at the three month mark, which is extremely early, while team tokens begin to unlock at the six month mark. These are both VERY early unlocks based off other ICO’s (ideally one year for advisors and two years for team members) and as such, increases the risk of holding tokens past the three month mark for the project, as at that point the circulating supply of tokens will begin to increase dramatically.

The Lition team have confirmed unsold tokens from the private and public sales will be burnt.

Users from the United States, Nigeria, North Korea and China are excluded from contributing to the TGE.

Roadmap

Lition was founded in Q4 2017 with three corporate identities set up to facilitate the token sale and ongoing development of the ecosystem. Lition Foundation is the main holding entity, with Lition Technology AG set up as a subsidiary of the foundation, both based in Liechtenstein, while Lition Energie GmbH is registered in Germany and is the holder of the energy supplier license.

From Q4 2017 to Q1 2018 Lition released Alpha and Beta version of their P2P energy trading application and received a license as an energy supplier in Germany, allowing for the first green power plants to be connected to the P2P energy trading application.

Q2 2018 marked the formal partnership with SAP and the integration of Smart Readers into the P2P energy trading use case.

Q3 2018 along with the technical whitepaper and initial blockchain prototype marked the introduction of the P2P energy trading pilot.

In Q4 2018 seed funding was completed ($2m USD) and the testnet MVP was set to private release.

Testnet 1.0 has been launched in Q1 2019, with the first dApp use cases onboarded onto testnet in the coming month (one assumes this is the banking/real estate use case). The ICO will also be held in Q1 2019 on March 18th.

The private release of mainnet v1 is scheduled for Q2 2019 and also marks the Genesis phase of the Lition chain. dApps on testnet will be migrated to mainnet at this stage and the STO offering will be extended past the initial real estate use case.

The public release of mainnet v1 is set for Q3 2019, with this marking the first major milestone of the Lition blockchain. It is worth noting that data deletion, a major feature of the Lition chain, will not be available until Q4 2019, with the mainnet 1.5 update.

Q4 2019 is fairly mundane with an update to testnet and mainnet (1.5), with the major update being a release of an SDK that allows developers the ability to easily build and deploy on the Lition chain.

Mainnet 2.0 will be released in 2020 as a public release and will include the full set of features (it is unclear what exactly will be missing feature wise up until this point) and a larger scale marketing campaign designed to foster adoption of dApp development and enterprise use of the Lition chain.

As per usual, having tech developed and a short turn around to full production is always ideal. Keeping in mind, Lition is still in the testnet phase and that a fully functional mainnet will not be released until Q3 2019 (an approximate 6 month turn around) with a fully functional mainnet not released until 2020, this needs to be taken into consideration when looking at the project from an investment or adoption perspective.

What is most impressive about the Lition roadmap is the achievements that have already taken place prior to public fund raising. By the time the public fundraising round takes place in mid-March 2019, Lition themselves will have released testnet along with two distinct developed in house use cases. Additional project legitimacy stems from government recognition of Lition as a licensed energy supplier, the LITION tokens being classed as a utility token and the support of German blockchain law that allows the issuance of STO’s on the platform.

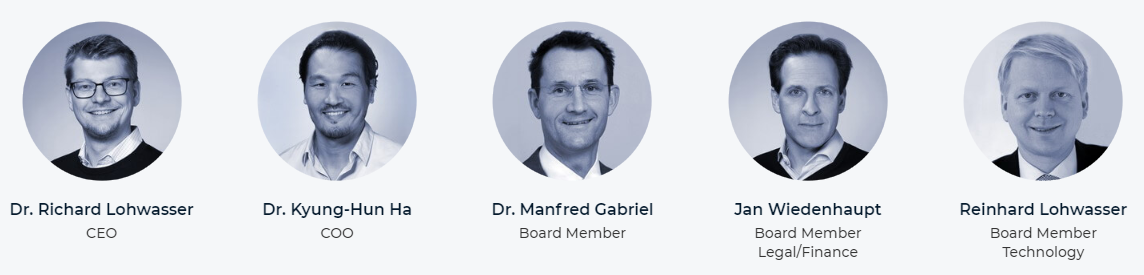

Team

The Lition project consists of a 5 man leadership team, an 8 person core team, an 8 person development team and a 5 man advisory team. In total 26 team members make up the project.

— Ph.D. in Energy Economics from RWTH Aachen University

— Youngest ever director of Vattenfall ($10b USD European utility corporation)

— Founded Clanintern.de in 1999 (a top 10 website (at the time) with over one million page views per day)

— Former Managing Director at ExtraEnergie (responsible for over 350 employees and over $1b USD in sales)

— Youngest ever director of Vattenfall ($10b USD European utility corporation)

— Founded Clanintern.de in 1999 (a top 10 website (at the time) with over one million page views per day)

— Former Managing Director at ExtraEnergie (responsible for over 350 employees and over $1b USD in sales)

- COO Dr Kyung-Hun Ha

— MBA and Ph.D. in IT from ESCP Europe

— Former Director of Online at Vattenfall

— Senior Director of operations at GASAG ($1.4b USD energy supplier in Germany)

— Founder of five start-ups in the tech and ecommerce sectors

— Former Director of Online at Vattenfall

— Senior Director of operations at GASAG ($1.4b USD energy supplier in Germany)

— Founder of five start-ups in the tech and ecommerce sectors

— Ph.D. in Business from University of St.Gallen

— Founding Partner of ADVISUM (invested over $1b USD in real estate and project developments in Germany)

— Former Managing Partner at GCI Management

— Former Account Manager at Cap Gemini (worked with Deutsche Bank, BMW AG and Citigroup)

— Account Manager at Cap Gemini

— Invested in more than 100 companies with approx. 35.000 total employees and a combined revenue of more than $7b USD

— Founding Partner of ADVISUM (invested over $1b USD in real estate and project developments in Germany)

— Former Managing Partner at GCI Management

— Former Account Manager at Cap Gemini (worked with Deutsche Bank, BMW AG and Citigroup)

— Account Manager at Cap Gemini

— Invested in more than 100 companies with approx. 35.000 total employees and a combined revenue of more than $7b USD

— Diploma of Business and Engineering from Technische Universität Berlin

— Founding Partner and Managing Director of ADVISUM

— Former Management Board at GCI Management

— Former Engagement Manager at Cap Gemini

— Developed, invested in and jointly managed funds for institutional investors of more than $700m USD

— Founder of four start-ups

— Founding Partner and Managing Director of ADVISUM

— Former Management Board at GCI Management

— Former Engagement Manager at Cap Gemini

— Developed, invested in and jointly managed funds for institutional investors of more than $700m USD

— Founder of four start-ups

— Masters Degree in Physics from Ludwig-Maximilians Universität München — Masters of Business Administration from Penn State University

— Managing Partner at ADVISUM

— Former Global Product Management Team Lead at Lucent Technologies

— Former Research Scholar at Lockheed Martin

— Founder of three start-ups

— Managing Partner at ADVISUM

— Former Global Product Management Team Lead at Lucent Technologies

— Former Research Scholar at Lockheed Martin

— Founder of three start-ups

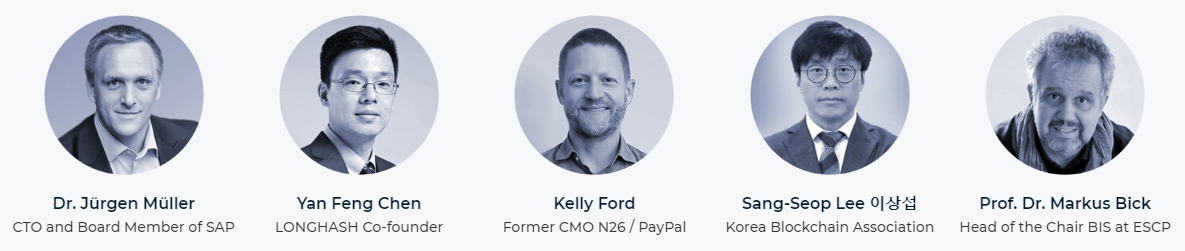

The Lition has several impressive advisors, most notably Dr Juergen Mueller and Kelly Ford.

— Ph.D. in IT Systems Engineering from the Hasso Plattner Institute

— CTO and Board Member at SAP (over 335,000 customers in over 180 countries and €22b in revenue per annum)

— CTO and Board Member at SAP (over 335,000 customers in over 180 countries and €22b in revenue per annum)

—Degree in Electrical Engineering/Computer Science from Stanford University

—Former Chief Marketing Officer of European mobile bank N26

—Masters of Business Administration from INSEAD

— Former CMO at PayPal in Germany, Austria and Switzerland

— Former Head of Marketing at eBay

— Former Senior Director of Marketing at McAfee

— Former Director of Media Strategy at AOL

—Former Chief Marketing Officer of European mobile bank N26

—Masters of Business Administration from INSEAD

— Former CMO at PayPal in Germany, Austria and Switzerland

— Former Head of Marketing at eBay

— Former Senior Director of Marketing at McAfee

— Former Director of Media Strategy at AOL

- Yan Feng Chen

The Lition core team consists of the usual BDM’s, marketers and managers one would expect from a project of this size. All employees from the core team appear to be permanent employees of Lition from their LinkedIn profiles.

The Lition development team appear to be outsourced from Instinctools, a software development company headquartered in Stuttgart, Germany with a development studio situated in Belarus (housing over 200 developers). Interestingly, Instinctools lists SAP as a client and one would suspect this is where the common connection between Lition, SAP and Instinctools has been made.

A full list and description of all team members can be found on the Lition website.

The Lition team is one of the more impressive aspects of the project with the main strengths stemming not only from the educational and entrepreneurial credentials of the leadership team, but also their ties into the energy and investment sectors in Germany. ADVISUM, of which several of the leadership team hold position in, appears to have taken a stake in the project at seed level and skin in the game from team members is most welcome in an ICO space in which most projects simply take and spend investor money and award themselves tokens regardless of the success or failure of a project. Both Richard and Kyung-Hun have held management roles in large German energy companies, with GASAG, at this point in time, acting as the main energy supplier to the Lition platform, with seven of it’s plants already listed in the energy trading application.

Obviously key to the value of the team is the attachment of Dr Juergen Mueller to the project. Having the current CTO of SAP working directly on the project, notably with a co-development agreement in place between Lition and SAP that includes SAP covering developer headcount at Lition, this extends this partnership from merely a partnership for names sake into a fully fledged working relationship. Keeping in mind the use case for Lition extending past simply being an energy trading application and into the realm of a bespoke blockchain designed for enterprise use, and with SAP having a worldwide customer base of 400 000+ customers, this relationship has great future potential for Lition (and is covered in more detail below in the Partnerships section).

Competitors

With energy trading being the main use case for Lition at this point in time, current comparisons in the whitepaper have been made with other energy projects, however as previously mentioned, it is worth keeping in mind that Lition will actually compete in several market sectors past energy trading with their banking/loan use case (developed in house) being released in Q1 2019, along with the ability to host STO’s on the platform also being ready in Q1 2019 (with the first hosted STO, via Lition’s real estate partner launching in Q3 2019 once mainnet has been released).

What separates Lition from other energy trading platforms is the combination of a working (although on testnet until Q3 2019) energy exchange platform with existing agreements already in place with seven power facilities in Germany, managed by GASAG, along with exposure to an existing mass energy market of up to 80m people…with an approved license as an energy supplier to sell energy to this market.

Due to the development of their own blockchain, Lition is also able to stake a claim at an infrastructure level to other blockchain projects. Most notable is the point of difference Lition has to other blockchains that support private chains, namely Hyperledger and Polkadot, neither of which support the deletion of data on their chains. The most recent similar comparison to a layer 2 solution that includes both data deletion and public/private chains is LTO.

With the enterprise blockchain niche moving forward in this public/private structure and with such offerings in Europe required to remain compliant with GDPR regulations, Lition currently occupies a relatively new and untouched sector of the blockchain market. Lition also is differentiated to other projects with additional features such as STO issuance and compliance and plans to facilitate a fully fledged dApp ecosystem, encouraging and incentivising developers to build dApp’s on the Lition chain. By the time Lition’s mainnet launches in Q3 2019 it will have three distinct use cases built on top of it, the energy trading application, the banking/loan application and the STO listing ability, past the general use case of the blockchain itself.

Partnerships

The SAP partnership with Lition is one of the key strengths of the project, with the partnership being phrased as a “co-innovation contract to work on solving the limitations of today’s blockchain infrastructure like privacy, speed and transaction costs”.

There are two things most notable about this partnership past the brand awareness that comes with the association with one of the biggest players in tech. Firstly, SAP are actually covering some of the ongoing development costs of developing the Lition blockchain, reducing the costs of development and deployment at Lition’s end. Secondly is the plan for SAP to “further integrate the (Lition) blockchain into their existing product portfolio and offer it to their over 400,000 customers”.

Lition CEO Dr Richard Lohwasser recently stated in their Telegram group —

“SAP currently only offers the 3 blockchain technologies quorum, hyperledger and multichain. these are commodity solutions that are available to everyone and SAP just hosts nodes for them. This is what the partnership with Modum etc. is about, they are all dApps whose blockchain apps are hosted and supported by SAP. The Lition cooperation is different, as we both work on generating a next generation blockchain infrastructure as layer below the dApps. Unlike the existing 3 blockchains mentioned above, ours is both public and private (all others are only private), and is legally compliant as it allows deletion of data (none of the others offer this). This is a competitive advantage for SAP and their clients, and the dApps running on the Lition blockchain.”

The Lition whitepaper details these additional uses cases for the Lition blockchain in more detail (pages 45–47).

GASAG is the main natural gas vendor in Berlin and was founded in 1847 (not a typo, it really is that old) with 1600 odd employees and over $1.4b USD revenue per annum. GASAG is the sole energy provider listed on the Lition energy trading application at this point in time, with seven of it’s plants listed on the MVP, actively trading energy. Lition co-founder Dr Kyung-Hun Ha is the current Senior Director of Operations at GASAG, meaning similar to SAP, this is more than just a partnership for names sake.

- VR Bank

The Volks- und Raiffeisenbank (VR-Bank) is a German co-operative banking group that together has 11.000 branches, 915 cooperatives, assets of € 891 billion and 18.5 million customers as of 2017. The Cooperative Financial Network consists of well-known German mortgage banks, Bausparkasse Schwäbisch Hall, R+V Versicherung, Union Investment, VR Smart Finanz (formerly VR Leasing), TeamBank, and DZ PRIVATBANK. In 2017, the Cooperative Financial Network’s net interest income was €18.6 billion. The consolidated net profit before taxes was €8.9 billion, an increase of 7.3 percent and its equity is calculated at €104.4 billion.

- Real Estate Partner

As mentioned previously in the article, Lition have a further partnership announcement with an as yet unnamed Real Estate entity, a real estate development company with “over $100m USD in assets”. Of course this partnership cannot be fully judged until officially announced but is promising news none the less, especially considering the intended Banking/Syndicated loan use case.

Summary

Lition is an compelling project in the sense it is many things wrapped up into one. While the main offering on initial viewing is that of an energy trading platform, by developing the Lition chain as the underlying architecture for this (along with the other defined use cases), Lition is actually much more than it seems at an initial glance.

With a push towards enterprise level chains that offer privacy and data management as core selling points, while enabling enterprise the ability to deploy their own chains on top of an existing framework (without having to incur the serious upfront costs of developing their own chains) and with the backing of SAP and it’s existing client base of 400 000+ enterprise customers, Lition is in an unique position to capitalise on what is sure to be burgeoning niche of the blockchain market.

The Lition project is further strengthened by serious partnerships with the likes of SAP and GASAG, with additional partnerships in the banking and real estate sectors soon to be announced. The recognition of the German and Liechtenstein governments regarding the utility use case of the token, along with the ability to host STO’s on the platform and a license to sell energy to the retail mass market in Germany, means Lition has several distinct and appealing use cases from the get go, before the pure use of its individual blockchain is taken into account.

With so many similarities to LTO, and with a few major differences that extend the use case for Lition past that of LTO, does Lition have the potential to be the next LTO?

TLDR Summary;

- ICO launches on the 18th of March

- Hardcap of $8m USD, softcap of $2m USD which has already been reached. Raising funds in ETH & BTC

- Partnership with SAP. SAP is partly funding development of the Lition blockchain along with offering it to their over 400 000 customers

- Partnership with GASAG. GASAG is one of Germanies larger energy suppliers with over $1.4b annual revenue and has 7 of their energy plants already connected to the Lition energy trading application

- Partnership with VR Bank, a German co-operative banking group that together has 11.000 branches, 915 cooperatives, assets of € 891 billion and 18.5 million customers as of 2017

- Upcoming partnerships with a real estate development company with over $100m USD in assets to be announced

- Team has strong connections in the energy and finance sectors in Germany

- Layer 2 blockchain solution built on top of ETH using a public/private model that allows for the creation of public or private sidechains with deletable data

- PoS Algorithm that includes staking and nodes, a network transaction cost of max 0.01c USD and a three second block confirmation time

- Testnet recently launched. Private Mainnet in Q2 2019. Public Mainnet in Q3 2019

- Intends to be a fully fledged App ecosystem, allowing for easy deployment of dApps on the Lition chain/sidechains

- Energy Trading MVP live at http://demo.lition.de

- Licensed Energy Supplier in Germany via Lition Energie GmbH

- LITION token is recognised by the Liechtenstein government as a utility token

- Ability to host STO offerings on the platform

- Banking/Syndicated Loan MVP soon to be live

- Small supply of circulating tokens for the first three months (approx $2.5m USD), prior to seed, private sale and advisor unlocks at the three and six month marks

- HODL Highway program incentivises public sale contributors to hold tokens for up to six months for additional bonuses up to 30%

- Guaranteed Refund Parachute program reduces investment downside risk to 50% of invested funds, guaranteeing a 50% return on initial USD investment (secured by DAI stable coin), claimable six months after the date of the TGE

We have rated Lition at 82.25% in our blockchain project review sheet.

For more info visit our Telegram channel dedicated to Wolf Crypto Blockchain Project Reviews: https://t.me/WolfCryptoICO

Please note, the thoughts and opinions in this article are those of the writer and in no way should be considered financial advice.

Wolf Crypto Resources

Public Group: https://t.me/WolfCryptoPub

News Channel: https://t.me/WolfCryptoAnnounce

Twitter: https://twitter.com/WolfCryptoGroup

News Channel: https://t.me/WolfCryptoAnnounce

Twitter: https://twitter.com/WolfCryptoGroup

Bitcointalk username: fair111

Bitcointalk link: https://bitcointalk.org/index.php?action=profile;u=2660645

Komentar

Posting Komentar